|

|

|||

| If you are following the signs “End Road Work” and “Road Work Ahead”, it looks like more drama signs for your commute in the new year. Traveling in and around Riley Fuzzle and Rayford Rd, or if you’re anticipating a commute utilizing the Grand

As far as retail near the Benders Landing community, signs are showing new businesses on the way. Other than the existing grocer, a gas station and a pharmacy, Capital Retail Properties’ site poses new commercial centers indicating AT&T Wireless, The UPS Store, Chipotle, Whataburger, Bank of America, Pollo Loco, Starbucks Coffee, Today’s Vision, Made Ya Smile Dental, Mattress Firm, Pet Supplies Plus, JK Nails, and a possibly a sushi restaurant. In addition, there will be a Walmart Super Center and Panera Bread in the same area. Further east on Riley Fuzzle, will be Kroger, Pet Smart, Chick Fil A, Chilis, Popeyes, and Santikos Theatre – are expected at some point in the near future. Considering long-term growth associated with the area, and ExxonMobil’s campus a short drive away, one would think a brand fashion giant would woo the neighborhood. Convenience and value is what people look for in retail centers within their communities. Multiple food-type eateries – other than fast, would be appealing to families and couples so it’s not necessary to leave the area. A quaint deli, a tea room and a few white table cloth restaurants would most likely please many. For so many of us, it would be of tremendous value to grab a nice not to far from home.

|

|||

The Impact of Oil, Gas on the US Housing Market

Courtesy of Rigzone interviews Michele Marano on the impact of Oil on Houston Housing

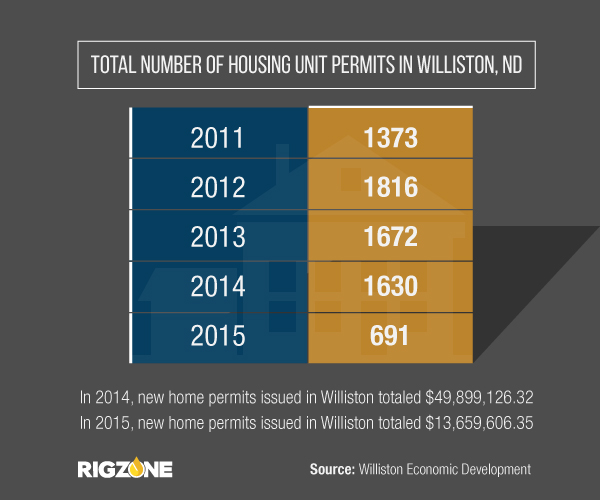

Just a few years ago, the industry was in an upcycle – oil prices were high, drillers had discovered new ways to extract oil and gas and jobs were plentiful in the oilfield. Workers flocked to oil-rich cities like Houston; Midland, Texas; and Williston, North Dakota. The housing markets in these areas saw a heavy increase in home sales. But these days, sales have slowed down quite a bit.

“We are not excelling anymore. We are maintaining,” Warren Ivey, managing broker and owner of Century 21 The Edge and regional vice president of the Texas Association of Realtors, told Rigzone. “While we’re not seeing a tremendous increase in prices on a monthly basis, we’re holding our own. The median price of a home last quarter (4Q 2015) was up by 0.3 percent.”

Ivey, who has worked in the Midland market for 10 years, said a balanced market should have 6-6.5 months of inventory. Currently, the Midland market has 3.5 months of inventory.

“A year ago, we had 2.4 months of inventory, so [sellers] were doing better then,” said Ivey. “Sellers are aware that we sold their properties within 17 days on the market last year. Now the average number of days on the market is 52. Our sellers aren’t panicking, but they’re asking what’s wrong?”

The significant decline in drilling activity in the Permian Basin plays a factor. The single family residential renting market in Midland has also been affected, noted Ivey.

“Prices have gone down and inventory has gone up,” he said.

Ivey believes this is due to many of the migratory workers – guys who were living in Midland and working on the drilling rigs.

“The people it took to operate those units were a migratory workforce. We saw a lot of them come in from places like El Paso, where the husband came and left the mother and children at home,” said Ivey. “When the overtime stopped and drilling activity slowed down, those workers probably went back home. They aren’t going to be re-leasing their homes.”

A Builder’s Perspective

Michele Marano, a Houston real estate agent and CEO of Real Estate for the Energy Professional, said builders – both national and statewide – who have deep pockets and have been in this situation before will have taken advantage of high sales before the prices of homes declined.

“The larger builder projects a turn in the market and has already factored lower prices into their inventory costs and longer carrying times,” Marano told Rigzone. Eighty percent of Marano’s clients are in oil and gas. “If they can’t carry property for six months or longer, those are the builders who will [hurt during this downturn]. The bigger guys have been through this before.”

John Sullivan, principal for Sullivan Brothers Builders, a homebuilder who constructed homes in the Springwoods Village community next to the new ExxonMobil campus just north of Houston, told Rigzone that he has not seen much of a slowdown in the housing market there.

Sullivan Brothers is responsible for building all of the homes in Harper Woods, an 88-home community in Springwoods Village. Right now, the community is halfway built out and Sullivan expects it to be fully built out within another year to year-and-a-half.

Sullivan said 40 percent of Harper Woods homes are ExxonMobil or Southwestern Energy clients; the rest are professionals in other industries. Prices for Harper Woods homes range from $350,000 to $650,000. Sullivan said home prices have not been impacted heavily by the price of oil.

“Our clients are not buying starter homes. These little spikes in the market, you have to get through it … and hold your prices,” said Sullivan.

Sullivan said Harper Woods currently has five built un-sold homes. Typically, they keep five to 10 available homes. They’re not overly concerned with the present market shift.

“This is our third down cycle. We’re in it for the long haul.”

Luxury Homes Taking a Hit

Houston’s higher end housing market hasn’t fared as well during the market shift.

By definition, luxury real estate is property that has an appraised value of more than $1 million, however the term is thrown around a lot in the real estate industry and used quite loosely, said Marano. The meaning is weighed heavily by location, but can also vary based on one’s perspective and means of style.

“According to the Houston Association of Realtors (HAR), homes priced at $500,000 and up have had a decline in sales every month since September 2015,” she said. “That market is taking the biggest decrease in sales.”

A monthly report by HAR revealed that Houston saw a 22 percent drop in luxury home sales in November 2015.

– See more at: http://www.rigzone.com/news/article.asp?hpf=1&a_id=143371#sthash.p05rlRpL.dpuf

Paying Less at the Pump

Courtesy of Rigzone – Rigzone interviews Michele Marano on lower gas prices and housing prices.

|

by Matthew V. Veazey DownstreamToday Staff |

|

March 01, 2016 As this graph from the American Automobile Association (AAA) shows, the U.S. average price for a gallon of gasoline has fallen dramatically since the second half of 2014. As of February 8 of this year consumers were paying an average of $1.74 per gallon of gasoline, representing a 44-cent year-on-year decline, according to AAA. Barring any significant supply disruptions, AAA expects the low-price trend to continue for the near term. A limited victory? “Consumers are definitely the biggest winners when it comes to cheap gasoline,” said Alex Goldstein, founder and CEO of Chicago-based energy retailer Eligo Energy. “They are able to immediately see the difference of lower prices at the pump in their checkbooks and as a result will be more likely to use their savings in other areas of the economy. Industries such as manufacturing, agriculture and transportation also benefit from low fuel prices, said David Holt, president of the Consumer Energy Alliance (CEA), which counts representatives of those sectors among its membership. “Reducing the cost of energy for those sectors of the economy helps their bottom line,” he said. Noting that cheap fuel “absolutely” benefits the economy, Holt contends that two factors have nonetheless diminished its positive impact. First, a “convoluted, inconsistent” regulatory regime has made the U.S. energy market among the world’s least predictable, he said. “That unpredictability does trickle down” in the form of price complications in the energy market that affect other sectors of the economy, Holt explained. In addition, Holt pointed out the U.S. economy has sunk into a recession or is on the verge of doing so. “What you’re seeing now is a downturn in commodity sectors,” he said, adding that consumer demand is not as robust as it could be. Two gauges of consumers’ attitudes about the economy – one from The Conference Board and another from the University of Michigan – underscore Holt’s concerns about demand. “With reduced prices for consumers, theoretically every household gets, say, $2,000 more in their pockets every year,” Holt said. “You’d think that money’s getting spent, but with the high levels of unemployment and underemployment it’s not having the same economic effect as it has had in the past.” Further stifling consumer demand is a faltering upstream oil and gas sector, which for much of the past decade has stood out by exhibiting robust growth, added Holt. “Now that oil and gas is in a downturn, that’s probably contributing to the lower benefit (of cheaper energy) to the broader economy,” he said. “Low oil and gas prices do help consumers in the short term by reducing fuel and electricity bills and increasing the amount of disposable income,” added Uday Turaga, founder and CEO of Houston-based energy consulting firm ADI Analytics LLC. However, he pointed out that a prolonged low-price environment can hurt a number of major economic sectors. “Sustained periods of low oil and gas prices would … significantly curtail capital spending by oil and gas companies and thereby business for other economic sectors such as steel, industrial equipment, engineering and construction services,” he said. For instance, he said these industries are feeling the effects of reduced activities in shale plays in states such as North Dakota, Pennsylvania and Texas. Even refiners, who until recently reaped the benefits from cheap crude oil, are beginning to feel the pinch from low fuel prices. The inexpensive feedstock, coupled with solid demand, prompted refiners to process greater crude oil volumes. Increasing utilization demanded greater fuels storage, and inventories of |

|

gasoline and distillates are now unusually high. According to the U.S. Department of Energy’s Energy |

||||

|

Information Administration (EIA), U.S. gasoline stocks are well above 5-year norms and distillate stocks are at the top of the range for the period. As Bloomberg recently reported, U.S. refiners have begun to scale back fuels production to cope with the glut. For European refiners, a similar trend is playing out. Reversing their recent trend of strong earnings, refiners are expected to see more modest profitability in 2016. |

||||

“Although cheap gasoline prices are good for the consumer, the longer-term effects can be bad for the economy,” concluded Marano. “All property, whether commercial or residential, is affected by lower gasoline prices … and this does have an impact on construction of new buildings, retail centers, office space, etc. The upside to this is that with lower property values, this can be viewed as an investment opportunity for those who are able to buy and build now, or buy and hold for a sale or construction at a later time.” |

Real Estate Love Match

REAL LOVE, REAL ESTATE: THINKING IN TERMS OF LOVE WHEN BUYING A HOME.

MICHELE COMPARES LOVE AND MATCHMAKING TO BUYING A HOME. WHY WOULD YOU BUY A HOME YOU ARE NOT IN LOVE WITH?

Love Lesson 1: Be Prepared to Make the Commitment.

Shopping for a home is like looking for a mate. Until your ready to make the commitment, you’re probably not ready to settle down with a home. Ask yourself first if you’re willing to take on the responsibility of owning up to being a good homeowner.

Love Lesson 2: Know What You’re Looking For.

Do you require the 5 star treatment? Have a good idea what attracts you to a property. Look for characteristics that please you. Draft a list of requirements that you desire so that when you’re ready to settle down, you are shopping the right criteria.

Love Lesson 3: Keep “Geographically Desirable” in Mind.

This element is extremely important because location determines how conveniently located your home is to your lifestyle. Also, consider the value of the location vs. the price. Look at the surroundings and ask yourself if there are possibilities of growth, improvements and changes that will either hurt or harm your value.

Love Lesson 4: High Maintenance May or May Not Work for You

First impressions are everything, however, look at the overall property and its good and bad points. Consider the repairs and improvements that may be necessary and its associated costs before you move on. Keep your list in mind. You will need to know how to identify the qualities that please you, without being distracted by little things that don’t really matter.

Love Lesson 5: Your Property is a Reflection of You.

Your home should please you and make you happy. In other words, it should say a lot about the person you are. Everything you like in life is somewhere reflected in your home, whether it is style, color, or personal belongings. Loving where you live is part of the romance of owning.

Love Lesson 6: Nurture it Extensively.

If you treat your home with care, chances are, you’ll have fewer problems in the future. If something breaks, take care of it timely, rather than letting a maintenance issue become a bigger, costly repair. Taking proper care and paying attention to maintenance will most likely bring you a favorable return in the long run.

Love Lesson 7: Investigate the Red Flags but Don’t Judge by a Bad First Impression.

Determine how much you are willing to put into it. If it’s going to require a lot work, maybe it’s not for you. Determine how extensive the repairs or improvements are before purchasing. If it requires high dollar repairs or a complete overhaul, consider your checkbook and schedule. It may work for you in the long term, but in the interim, your life may be a disaster.

Love Lesson 8: Considering Multiple Homes

If you’re buying a second (or third), decide if you really have the time, money and responsibility to put into it. There is always the risk of owning more than one home and not being able to enjoy the purpose of having it. A second home needs to be treated as good, if not better than the primary.

Love Lesson 9: Determine whether it is Long or Short Term

When considering a purchase, be realistic about how long you plan to hold the property. If you are planning to stay short term, you may not want to buy the highest priced home on the block. Pay close attention to the location in which you are buying and be aware of the surroundings that could affect its value. If you plan to hold the property for many years, consider the same factors; however, be sure it is a home you absolutely love, while making sure you can grow into it and not out of it.

Whether you are buying long or short term, identify the condition of the economy and the current real estate market. This will have a lot to do with your negotiating power.

Love Lesson 10: Head Over Heals

The most rewarding part of owning is falling in love, day after day, when you walk in to your home. If you haven’t experienced that…..you’re probably not in love and may want to consider making some changes.

Chinese buyers feed new energy into Texas real estate

“Investors in Chinese equity markets will flee to safe assets, and few assets offer the combination of relatively modest risk and high returns as U.S. real estate,” says a researcher at Zillow.

Tuesday, 28 Jul 2015 | 10:58 AM ETCNBC.com

For the full article with Diana Olick – CNBC interview with Michele Marano

http://www.cnbc.com/2015/07/28/chinese-buyers-feed-new-energy-into-texas-real-estate.html

What Determines Value in a Changing Market?

What determines Value in a Changing Market?

I am currently in the market for a home. I found a builder who caught my attention in an area under construction, 37 homes inside a gated community. Although this development is not quite flourishing, still with half the number of lots available, my concerns of value outweigh the personal attachment I have to stone front elevations, tile roofs and1-story floor plans in an ideal location.

The 2 most important factors to consider in determining value come down to location and timing. There are areas, which dictate higher values and will appreciate far faster than others. Some areas may not increase in price at all, even over many years and these are the reasons why.

If you are buying at a time when the market has already reached a peak (and how to know when that is-to be discussed in my next article), be cautious if you are paying full price. There are areas where new home construction is still going strong. The significant question to ask is whether an area is going to flourish right away or if it will take years for the value of your home to catch up to the number, which it was purchased at? If you buy in a new development where there is enough land to allow building for years, then chances are the value of your home will not increase until the community is completely finished. Supply has to be limited in order for prices to increase and the market needs to remain healthy. If the inventory is excessive, and demand is not, prices will lower or not increase.

If you buy in an area where there isn’t excess land for new development, and considering the location is attractive, your purchase may show a substantial increase over time. Areas where there is minimal room for new construction, leaving only existing lots for teardown and rebuild will help prices increase in the neighborhood.

Timing has a lot to do with value in a purchase because the dollar value at the time of purchase may or may not be in line with the position of the market. For example, if you paid full price for a home when the market was steadily moving in sales, prices may have been overinflated from where they would traditionally have been. When supply is low and demand drives a market, prices accelerate, and a furry in buying may have put you in a home, but at a disadvantage in the price you paid. Let’s be realistic. No market ever stays the same. Many economic factors will cause a rise or a decline in momentum, resulting in price changes in homes. The most important point is that real estate doesn’t change over night. It takes time for economics to affect a market and make an impact. So head the rush, as things in the market will change; it just takes time to see the turn.

The Art of Negotiations

Negotiations result in more than a handshake.

When it comes to negotiations, Donald Trump has always been my favorite in demonstrating how it’s done. Now, with over more than a decade of practicing, I have found my own style and techniques that work.

Having worked for years in an environment where negotiations were ingrained in every deal, I was automatically trained from some of the best dealmakers on Wall Street. Today, every deal I touch involves negotiations and it is rare for a deal to get by me with out some aspect negotiated.

Being involved in today’s market where the buyer is no longer writing full offers, negotiations are necessary. Taking factors into consideration, such as global and national economics, and also the client’s needs and concerns, all are part of the means of negotiating. This plays into how much, when and how hard you vie for your position.

If one party understands negotiations, and the other does not, the deal will lean in favor of the party who knows how to negotiate so it is important in understanding which side of strength you are on.

Negotiating is an art. It is a tool that is taught but it is inherited as a natural talent. The shrewdness of an individual’s business understanding will drive the competency of the negotiator.

Determining Home Values in a Volatile Market

I have had a number of conversations with real estate clients – many of whom are energy industry professionals- regarding the real estate market. Whether the energy professional is overseas or here locally, or looking to purchase or sell, the conversation is one that is shared, as it applies to my current situation as well.

I too am in the market to buy. I found a builder who caught my attention in an area under construction, 37 homes inside a gated community. Although this development is not quite flourishing, still with half the number of lots available, my concerns of value outweigh the personal attachment I have to stone front elevations, tile roofs and1-story floor plans in an ideal location. The 2 most important factors to consider in determining value come down to location and timing. There are areas, which dictate higher values and will appreciate far faster than others. Some areas may not increase in price at all, even over many years and these are the reasons why.

If you are buying at a time when the market has already reached a peak (and how to know when that is-to be discussed in my next article), be cautious if you are paying full price. There are areas where new home construction is still going strong. The significant question to ask is whether an area is going to flourish right away or if it will take years for the value of your home to catch up to the number, which it was purchased at? If you buy in a new development where there is enough land to allow building for years, then chances are the value of your home will not increase until the community is completely finished. Supply has to be limited in order for prices to increase and the market needs to remain healthy. If the inventory is excessive, and demand is not, prices will lower or not increase.

If you buy in an area where there isn’t excess land for new development, and considering the location is attractive, your purchase may show a substantial increase over time. Areas where there is minimal room for new construction, leaving only existing lots for tear down and rebuild will help prices increase in the neighborhood.

Timing has a lot to do with value in a purchase because the dollar value at the time of purchase may or may not be in line with the position of the market. For example, if you paid full price for a home when the market was steadily moving in sales, prices may have been overinflated from where they would traditionally have been. When supply is low and demand drives a market, prices accelerate, and a furry in buying may have put you in a home, but at a disadvantage in the price you paid. Let’s be realistic. No market ever stays the same. Many economic factors will cause a rise or a decline in momentum, resulting in price changes in homes. The most important point is that real estate doesn’t change over night. It takes time for economics to affect a market and make an impact. So head the rush, as things in the market will change; it just takes time to see the turn.

______________

All Eyes on Texas Real Estate

http://oilpro.com/post/9722/all-eyes-texas-real-estate

When you live in a state heavily influenced by oil, saddle up and hold on for the ride. What comes up must come down and real estate has room on the downside. The real question is really just how much. When I visit with nine out of ten of my clients, who are all energy professionals, they have one thing in mind, housing pricing in Texas. They buy out of need, but wait, didn’t most people already buy when Texas was booming?

Demand poured in and buying was frenzy. Now, demand is leveling off and prices will too. Where you purchased will dictate whether it’s a reward or will be at risk. If you think you’ll find a goldmine this time around, think again. The last time I saw a foreclosure in Tanglewood, Houston people were lined up for showings and that was when banks weren’t even lending money. Now, Texas has more money pouring into the economy from all parts of the globe and a “deal” might be just being happy with current pricing.

Considering the square foot of residential pricing is not at $2500.00, yet, there are lots of deals out there. It’s all relative to what you’re used to. Getting something that’s already discounted isn’t such a bad deal even though it doesn’t have a sale tag on it. But watch out for those new high rises. Now that crude is at $50.00 a barrel, you may want to think twice about buying that new penthouse. If you already have, when crude was priced at $100.00, well, let’s just say you might just have to wait for the next merry-go-round. High-rises take about as long to build as a boom, so by the next time we see $80.00 oil, buyers will be back at those doorsteps again too.

Texas is a rare breed when it comes to real estate. It’s a prize in itself. It’s my job to convince clients to keep their eyes on the prize and be prepared for price fluctuations in real estate until the price of crude levels. Although it’s still too early, be prepared. If you snooze, you lose and what may have been considered a deal, may already have been a deal closed by someone else. For $120,000.00 you can get a fully renovated 740 sq. ft. condo in a desired neighborhood. If that’s not a deal, look at the $850,000 price tag for a 30-year old, 650 sq. ft. condo-type coop in Chelsea, New York. It seems some builders in Texas are striving for the $2500.00 Tribeca, New York square foot prices, but now they may need to put on the breaks. The boom was great but Texas pricing still hasn’t neared Manhattan’s.

Being savvy with Texas real estate can be a talent or a curse. It doesn’t take a genius to figure out the correlation between oil and real estate. When one goes down you can’t expect the other to go in the opposite direction. This is not the East Coast or California and even though jobs flourish here, real estate boundaries stretch far and wide and demand will not hold the same as when oil was priced at $100.00 a barrel.

What goes up must come down and real estate will come down. If you bought in one of those areas where builders picked up the last scraps of land, hold on to your saddle ‘cause it too will rebound the next time around.

>*Michele Marano is a licensed Real Estate Profesional and the Director/Founder of Real Estate for the Energy Professional, Champions Real Estate Group.*

Parkway, signs of completion are not that far in the horizon. According to the Grand Parkway Association, “Segment F1, 290-249, and Segment F2, 249 to 45N will likely open first, possibly in February 2016. The direct ramp from 45 SB to GP WB and GP EB to 45 NB will open with segment F2. Segment G, 45N to 59N, will open later, likely in March 2016. The ramps at Hardy Toll Road will not open until the contractor for Harris County completes their work. That means the area around Riley Fuzzell, and the Tollway will not open until March 2016.”

Parkway, signs of completion are not that far in the horizon. According to the Grand Parkway Association, “Segment F1, 290-249, and Segment F2, 249 to 45N will likely open first, possibly in February 2016. The direct ramp from 45 SB to GP WB and GP EB to 45 NB will open with segment F2. Segment G, 45N to 59N, will open later, likely in March 2016. The ramps at Hardy Toll Road will not open until the contractor for Harris County completes their work. That means the area around Riley Fuzzell, and the Tollway will not open until March 2016.”